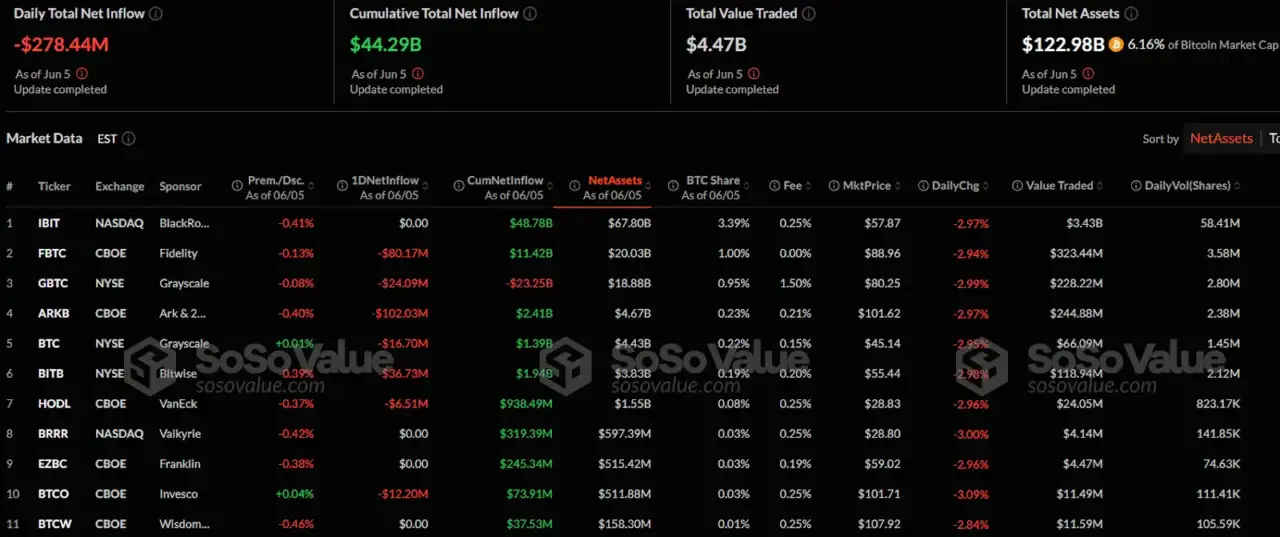

- Total daily net outflows across U.S. spot Bitcoin ETFs reached $278.44 million on June 5.

- IBIT maintained its lead with $67.80 billion in net assets despite no new inflows.

- ARKB posted the largest outflow at $102.03 million, while BRRR recorded no change.

In a recent SoSoVlue update as of June 5, the U.S. spot Bitcoin ETF market recorded a total daily net outflow of $278.44 million. Despite the pullback, cumulative net inflows remain positive at $44.29 billion. The total value traded for the day reached $4.47 billion, while total net assets across the ETFs stood at $122.98 billion.

IBIT Maintains Its Lead as FBTC Follows Closely

A deeper analysis of the individual ETFs indicates that BlackRock’s IBIT ETF showed no net inflow or outflow for the day, holding steady at $48.78 billion in cumulative inflow. However, IBIT continues to lead with $67.80 billion in net assets and traded $3.43 billion in value. The fund closed at $57.87, down 2.97% for the day.

Fidelity’s FBTC ETF posted the second-largest daily outflow, losing $80.17 million. Despite the decline, its cumulative inflow remains positive at $11.42 billion. It has $20.03 billion in assets and traded $323.44 million. The closing price stood at $88.96, reflecting a 2.94% daily drop.

ARKB, GBTC, BITB, and VanEck’s Stretch the Outflow as BRRR Hold

Grayscale’s GBTC ETF experienced a $24.09 million outflow, continuing its negative trend with a cumulative net outflow of $23.25 billion. GBTC’s net assets totaled $18.88 billion, and it closed at $80.25 with a 2.99% decline. ARKB from Ark Invest recorded the largest daily outflow, with $102.03 million exiting the fund. ARKB has a total net inflow of $2.41 billion and $4.67 billion in assets. The ETF closed at $101.62, marking a 2.97% daily loss.

Grayscale’s BTC fund registered a $16.70 million outflow, bringing its cumulative inflow to $1.39 billion. It holds $4.43 billion in net assets and closed at $45.14, down 2.95%. Bitwise’s BITB fund posted a $36.73 million outflow, with a total net inflow of $1.94 billion. Its net assets stood at $3.83 billion. The ETF closed at $55.44, falling 2.98%.

VanEck’s HODL ETF saw a $6.51 million daily outflow, with $938.49 million in cumulative inflows and $1.55 billion in net assets. The fund dropped 2.96%, ending at $28.83. Valkyrie’s BRRR ETF recorded no inflow or outflow and remained at $597.39 million in net assets. It ended at $28.80, down 3.00%.