Kraken Instant Buy charges 3.5% total fees (2.5% average spread + 1% explicit) vs 0.25-0.40% on Kraken Pro. Our investigation found that automated purchases cost DCA investors 9-14x more in fees compared to manual Pro trades. Detailed fee breakdown inside.

Key Points

- Instant Buy charges 3.5% total (2.5% average spread + 1% fee) vs. 0.40% on Kraken Pro for instant orders or 0.25% for patient limit orders.

- Kraken embeds spread costs in the ‘Price’ field without separate itemization, requiring users to compare against market rates.

- Kraken Pro lacks recurring buy automation while competitors like Binance and Bybit offer it at 0.08-0.10% standard fees.

Editor’s Note (Dec. 10, 2025) Following publication, a reader noted that limit orders are available on the standard Kraken app, not just Instant Buy. Crypto-News.Net conducted additional testing: a $10 limit order executed at $93,109 against a set price of $93,042, revealing fees of approximately 1.55% (1.478% explicit + 0.07% spread). This is significantly better than Instant Buy’s 3.5% but still 4-6x higher than Kraken Pro’s 0.25-0.40%. The limit order functionality is not prominently surfaced in the UI, and the experience requires manually setting prices and waiting for execution rather than immediate purchase. The core finding stands: Kraken Pro remains the lowest-cost option, and automated recurring purchases are still restricted to higher-fee tiers.

Kraken User Discovers 3.5% Hidden Costs on Automated Bitcoin Purchases

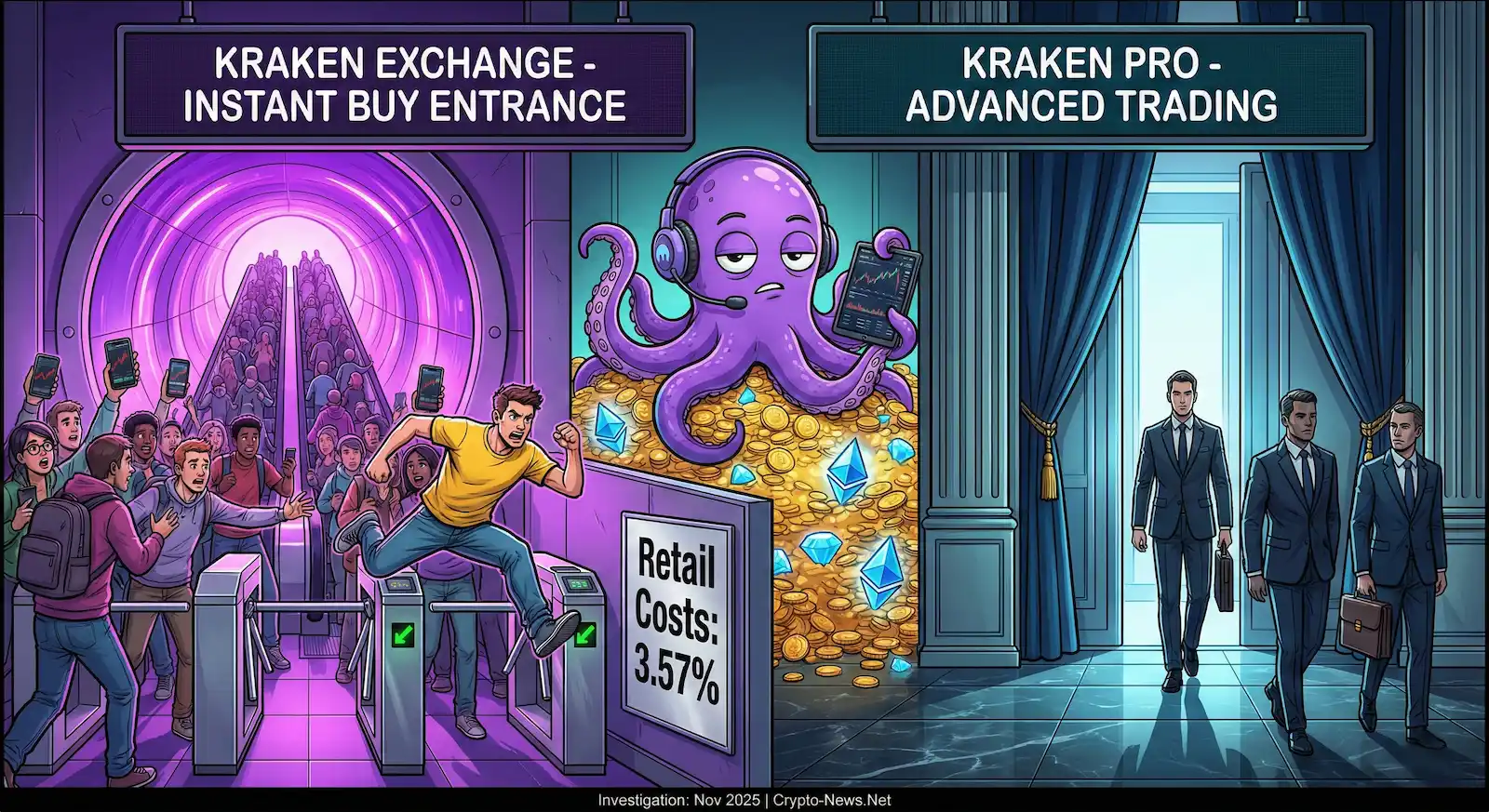

Kraken fees for automated Bitcoin purchases can cost investors up to 14 times more than manual trading, according to a Crypto-News.Net investigation. A Kraken user making daily $30 Bitcoin purchases noticed something unusual on Nov. 16, while Bitcoin traded at approximately $94,000 on spot markets, their purchase executed at an effective rate of $96,106 per BTC. The discrepancy prompted the user to contact Crypto-News.Net, leading to an investigation that documented total costs averaging 3.5% for automated purchases on Kraken’s Instant Buy feature, compared to 0.25-0.40% for manual trades on the exchange’s Pro platform.

The Kraken fee structure forces a difficult choice: automated recurring purchases are only available through Instant Buy, which charges a combination of spread markup and explicit fees. Users seeking lower costs must use Kraken Pro, which offers transparent low-cost trading but requires manual execution for every purchase.

The investigation found that no Kraken option combines both competitive fees and automated execution, forcing users to choose between convenience and cost.

Verification Testing: Instant Buy vs Kraken Pro Fee Comparison

The user’s Nov. 16 transaction receipt shows they paid 30.00 USDC total (29.703 USDC plus 0.297 USDC in explicit fees) and received 0.0003121 BTC, according to documentation reviewed by Crypto-News.Net. With Bitcoin trading between $94,000 and $94,200 on spot markets at the time, the effective purchase price of $96,106 per BTC represented a price differential of approximately $1,900 to $2,100, or roughly 2.0-2.2% above market rates. Combined with the explicit 1% fee shown on the receipt, the total transaction cost reached approximately 3.0-3.2%.

Crypto-News.Net conducted verification testing the same day at 20:51-20:52 CET, executing $10 USDT to BTC transactions across all three Kraken platforms. Kraken Pro Web showed a market price of 94,241.8 USDT with an estimated 0.04 USDT trading fee (0.4%). Kraken Pro Mobile showed similar results at 94,251.6 USDT with the same 0.4% fee structure. In contrast, Instant Buy on the standard Kraken mobile app quoted approximately 0.00010321 BTC for the same $10 investment, an effective rate of 96,891 USDT/BTC. The spread differential between Instant Buy and Pro Web came to approximately 2.81%, with testing confirming the additional 1% explicit fee documented in the user’s receipt, bringing total costs to approximately 3.8%.

The testing confirmed a consistent pattern: Instant Buy transactions cost approximately 2.5-3.8% in total, averaging 3.5%, while Kraken Pro charges 0.40% for instant market orders (called “taker” fees) or 0.25% for patient limit orders that wait for the market to come to you (called “maker” fees), according to Kraken’s official fee schedule. Most retail investors execute market orders, incurring the 0.40% taker fee, resulting in costs approximately 9 times higher on Instant Buy. Patient traders using limit orders pay only the 0.25% maker fee, widening the cost differential to approximately 14-fold for identical transaction amounts.

Testing showed spread variance from 1.5% to 2.8% depending on market conditions, with total costs ranging from approximately 2.5% to 3.8%. For annual cost projections, this analysis uses 3.5% as the representative average.

Fee Disclosure Practices

The disclosure structure reveals a multi-step process that obscures total costs. When users initiate an Instant Buy purchase, the initial screen shows only an estimated BTC amount (e.g., “That’s ≈0.00010321 BTC” for 10 USDC) with no price or fee breakdown. The final confirmation screen displays three fields: “Amount” (BTC to receive), “Price” (e.g., 96,046.6321 USDC), and “Kraken fee” (e.g., 0.099 USDC, representing 1%). The spread, the difference between the displayed “Price” and actual market rates, is embedded within the “Price” field rather than itemized separately. To discover the markup, users must manually remember the market price shown on Kraken’s homepage and calculate the percentage difference themselves.

Kraken’s Terms of Service state that “Instant Buy consists of a displayed fee and, where applicable, a spread which is included in the price” and that “Kraken may retain any excess spread from a transaction.” The documentation lists factors affecting spread, but never tells users the actual percentage or dollar amount before they complete a purchase.

By contrast, Kraken Pro displays market price (e.g., “≈94,241.8 USDT”) and estimated trading fee (e.g., “≈0.04 USDT”) as separate line items before trade execution. This structure allows users to see both the reference market rate and the explicit fee they’ll pay.

Real-World Cost Impact

To quantify the impact on retail investors, Crypto-News.Net calculated annual costs across four representative investment patterns using the documented 3.5% average Instant Buy fee structure and 0.40% Pro taker fee for market order execution.

Daily DCA Investors Pay $290 Automation Premium with Kraken+

| Investment Pattern | Annual Volume | Instant Buy Cost | With Kraken+ (incl. $4.99 sub.) | Pro Taker Cost (0.40%) | Pro Maker Cost (0.25%) |

| Daily $30 DCA | $10,950 | $383.25 | $333.63 | $43.80 | $27.375 |

| Weekly $100 DCA | $5,200 | $182.00 | $189.88 | $20.80 | $13.00 |

| Monthly $500 DCA | $6,000 | $210.00 | $209.88 | $24.00 | $15.00 |

| Bi-weekly $50 DCA | $1,300 | $45.50 | $92.38 | $5.20 | $3.25 |

$500 Monthly DCA Strategy: $186 Cost Difference

The additional annual cost of using Instant Buy instead of manual Pro trades (the ‘automation premium’) varies significantly based on investment frequency and volume.

Among these patterns, daily $30 DCA investors using Instant Buy pay $383.25 annually versus $43.80 with manual Pro market orders ($339 premium), or $27.38 with patient limit orders ($356 premium). With Kraken+ as the platform’s self-proclaimed fee solution, it still has a massive differential of $290 vs taker orders and $306 vs maker orders.

These calculations are mathematical projections based on the verified fee structure shown in the table above.

Platform-Wide Fee Impact

While individual investors face hundreds of dollars in annual excess fees, the combined cost across Kraken’s entire user base reveals the scale imposed by restricting automated purchases to high-fee tiers. Based on Kraken’s $2.6 billion annual revenue and documented fee structures, standard app users collectively pay an estimated $230 million to $460 million annually in excess fees compared to Kraken Pro rates.

Volume Distribution and Fee Tier Analysis

Cryptocurrency exchanges commonly follow a pattern where a small number of institutional traders generate the majority of trading volume at the lowest fee rates. Kraken’s platform-wide average fee of 0.112% (calculated from $2.592 billion revenue on $2.307 trillion annual volume) shows heavy concentration among high-volume traders who qualify for the lowest tiers.

The table below models a realistic volume distribution that produces this 0.112% average, accounting for Kraken’s tiered fee structure:

| User Tier | Volume Share | Annual Volume | Average Fee | Revenue Contribution |

|---|---|---|---|---|

| $10M+ institutional | 75% | $1.730T | 0.09% | $1.557B |

| $1M-$10M whales | 15% | $346B | 0.14% | $485M |

| $100K-$1M active traders | 7% | $161B | 0.19% | $306M |

| <$100K retail Pro users | 3% | $69B | 0.30% | $207M |

This concentration leaves between $230 million and $460 million in annual revenue attributable to standard app users trading at the 3.5% Instant Buy fee structure, depending on the actual breakdown between regular users and professional traders.

Aggregate Excess Fee Estimates

The methodology applies Kraken’s official revenue figures, verified fee structures, and volume tier constraints to calculate excess fees under different assumptions about retail participation:

| Scenario | Instant Buy Revenue | Annual Volume | Excess vs. Pro (0.40%) | Per User |

|---|---|---|---|---|

| Conservative (10% retail) | $259M | $7.4B | $230M | $55 |

| Moderate (15% retail) | $389M | $11.1B | $345M | $83 |

| Aggressive (20% retail) | $518M | $14.8B | $459M | $110 |

The conservative estimate assumes retail users generate 10% of platform revenue, reflecting Kraken’s significant institutional trading activity. The aggressive estimate assumes retail users generate revenue proportional to their share of funded accounts. Both scenarios maintain Pro platform average fees within realistic ranges for exchanges where large traders dominate.

These ranges align with the individual DCA patterns documented earlier: while the platform-wide average suggests $55 to $110 per user, active DCA investors contributing $5,000+ annually pay significantly more, consistent with the $186 to $339 individual excess fees calculated for specific investment patterns. The lower platform-wide average reflects that most standard app users make infrequent purchases rather than practicing systematic recurring investment strategies.

The Role of Consumer Awareness

This fee differential persists in part because users lack key information about their options. As documented in the Fee Disclosure Practices section, Kraken embeds the 2.5% spread markup within the “Price” field rather than itemizing it separately, requiring users to manually calculate the difference against market rates. The standard Kraken app does not prompt users to compare fees with Kraken Pro, and many retail investors remain unaware that a lower-cost alternative exists on the same platform.

Research from other industries demonstrates why platforms resist transparent fee disclosure. In 2015, StubHub conducted an A/B test showing customers subject to back-end fees spent 21% more and were 14% more likely to complete purchases compared to those shown full prices upfront, according to investor John Arnold’s analysis of the experiment. StubHub reversed its transition to transparent pricing after discovering this effect.

The architectural separation between the two apps, with different download requirements and user interfaces, further reduces the likelihood that casual investors will discover the 9-14x fee difference. This lack of awareness enables the excess fee structure to generate substantial revenue from users who would likely migrate to Pro if presented with transparent cost comparisons at the point of purchase.

The analysis demonstrates that Kraken’s architectural decision to restrict automated purchases to the Instant Buy tier generates between $230 million and $460 million annually in excess fees that would not exist if recurring buy functionality were available at Pro rates, as offered by competitors like Binance, Bybit, and OKX.

The Automation Trade-Off

Kraken offers three purchasing pathways, each with distinct limitations. Standard Instant Buy (3.5% total cost) includes automated recurring buy functionality and a beginner-friendly interface. Kraken+ subscription ($4.99/month) removes the 1% explicit fee but not the 2.5% average spread, making it cost-effective only for users investing more than $500 monthly. Kraken Pro provides fees of 0.25% to 0.40% for retail volumes, plus professional trading tools, but lacks recurring buy automation entirely.

The Kraken+ subscription presents a particular challenge for smaller investors. For users investing less than $500 monthly ($6,000 annually), the $59.88 annual subscription cost exceeds the 1% fee savings, making Kraken+ more expensive than standard Instant Buy.

The subscription only benefits users investing over $500 monthly, where the 1% fee savings offset the $4.99 monthly cost. Even at optimal usage, Kraken+ users still pay significantly more than Pro’s manual execution costs.

Kraken’s official documentation, published Aug. 8, 2025, explicitly states: “Recurring orders are currently not available on Kraken Pro.” This architectural gap forces users to choose between convenience and cost-efficiency, a trade-off that retail crypto investors must navigate when establishing automated investment strategies.

Crypto-News.Net contacted Kraken on Nov. 16, 2025 with detailed findings and specific questions about the fee structure, disclosure practices, and platform architecture decisions. A follow-up inquiry was sent Nov. 18 offering to discuss via phone call and condensing questions to focus on core disclosure concerns. Kraken did not respond to either request for comment by the original Nov. 19 deadline or by publication on Nov. 25, despite multiple opportunities to provide perspective.

Industry Comparison

Analysis of major cryptocurrency exchanges reveals that Kraken’s restriction of automated purchases to a high-fee tier diverges from industry practice. Binance offers recurring buy functionality at standard spot trading fees of 0.10% for both maker and taker orders. Bybit similarly provides automated purchases at 0.10% standard fees with no additional charges. OKX enables recurring buys at 0.08% maker and 0.10% taker fees, also using standard spot trading rates.

Binance and Bybit Offer Recurring Buys at 0.10% Standard Fees

| Exchange | Base Maker Fee | Base Taker Fee | DCA Support | DCA Fee Structure |

| Binance | 0.10% | 0.10% | Yes | Standard spot fees apply |

| Bybit | 0.10% | 0.10% | Yes | Standard spot fees apply |

| OKX | 0.08% | 0.10% | Yes | Standard spot fees apply |

| Coinbase | 0.60% | 1.20% | Yes | 1.49% + 0.5-2% spread |

| Kraken Mobile | ~1.0% | ~1.0% | Yes | 1% fee + 2.5% spread = 3.5% total |

| Kraken Pro | 0.25% | 0.40% | No | Manual execution only |

Kraken’s Automated DCA Costs Are 35x Higher Than Competitors

The comparison shows Kraken Pro’s fee structure of 0.25-0.40% is competitive with other exchanges’ advanced trading platforms. However, while competitors offer recurring buy functionality on their low-fee platforms, Kraken restricts automation to Instant Buy’s 3.5% cost structure. This represents costs 35-fold higher than Binance, Bybit, or OKX for identical automated investment strategies.

The investigation documents a significant cost differential between Kraken’s automated and manual purchase options, compounded by disclosure practices that embed spread costs within pricing fields rather than itemizing them separately. For the growing number of retail investors practicing disciplined recurring investment strategies, the architectural limitation forcing a choice between automation and competitive fees represents a material annual expense that diverges from industry standards where automation is available at spot trading rates.

Frequently Asked Questions: Kraken Fees

How much does Kraken Instant Buy cost?

Kraken Instant Buy costs approximately 3.5% total: a 2.5% average spread markup embedded in the purchase price plus a 1% explicit fee. For perspective, every $10,000 invested annually through automated recurring buys incurs approximately $350 in fees.

What is the difference between Kraken and Kraken Pro fees?

Kraken Pro charges 0.25% for limit orders (maker fees) or 0.40% for market orders (taker fees), compared to Instant Buy’s 3.5% total cost. This represents a 9-14x cost difference depending on order type. However, Kraken Pro does not support automated recurring purchases.

Does Kraken Pro support recurring buys?

No. According to Kraken’s official documentation published Aug. 8, 2025, “Recurring orders are currently not available on Kraken Pro.” Users must choose between Instant Buy’s automation at 3.5% costs or Pro’s low fees with manual execution.

Is Kraken+ worth it for small investors?

No. Kraken+ ($4.99/month) only benefits investors contributing over $500 monthly. For small-volume investors, the annual subscription cost exceeds the 1% fee savings. The subscription becomes cost-effective at approximately $500 in monthly investment volume.

How do Kraken’s automated purchase fees compare to competitors?

Kraken’s 3.5% automated purchase fees are 35 times higher than Binance (0.10%), Bybit (0.10%), and OKX (0.08-0.10%), which offer recurring buy functionality at standard spot trading rates without additional markups.

Disclosure

Crypto-News.Net editorial staff hold positions in Bitcoin but do not hold positions in Kraken or Kraken-issued securities. Kraken is not a current or past advertiser with Crypto-News.Net. This article is for informational purposes only and does not constitute investment advice. Readers should conduct their own research before making financial decisions.

Change Log

Edit: Dec 10, Added Editor’s Note documenting limit order testing on Kraken Standard app following reader feedback.

Edit: Nov 26, Fixed typos and editorial artifacts.