Bitcoin markets have gotten traders used to quite a bit of volatility through the last few days, yet traders have managed to help BTC/USD combat the ever growing selling pressure through the last few days. In so far, a bottom of $1020 levels might have been reached, but resistance seems to get easily exhausted amid the current market sentiment.

Major Signals

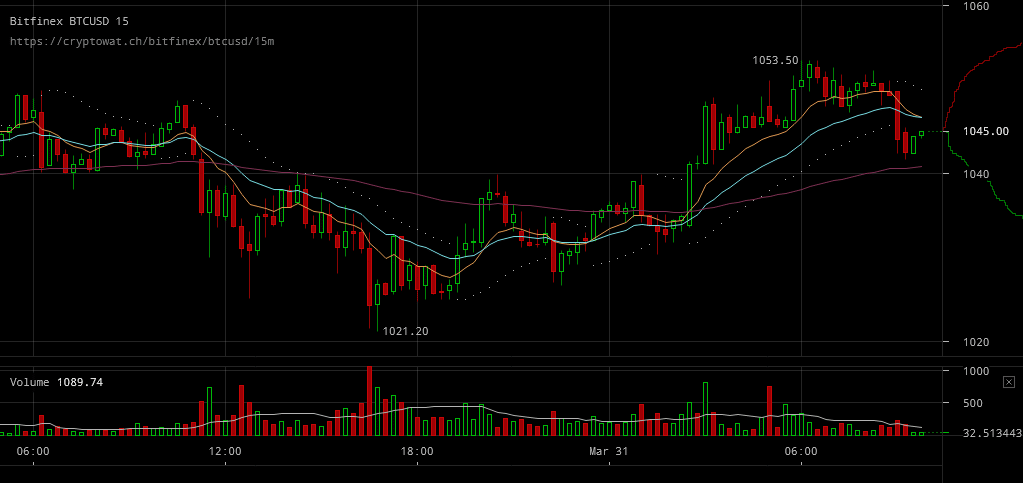

- Bitcoin prices might have reached a bottom of $1020 through the last trading session, yet trades managed to climb above $1050 since then

- Resistance at $1050 caused prices to settle below such levels, but selling pressure now seems more exhausted

- With sell walls only intensifying above $1050, it seems as though several traders are set to make a breakthrough harder

Bitfinex BTC/USD charts are quite indicative of how sizeable sell orders have fallen short at causing an exaggerated price drop. In so far, BTC/USD rates have managed to cut through volatility without any sizeable losses as prices have so far recovered from price drops observed through the last trading session. However, the sell walls formed at $1050 levels would surely make another breakthrough harder after the spike that briefly pushed prices above this level.

Bitfinex BTC/USD charts are quite indicative of how sizeable sell orders have fallen short at causing an exaggerated price drop. In so far, BTC/USD rates have managed to cut through volatility without any sizeable losses as prices have so far recovered from price drops observed through the last trading session. However, the sell walls formed at $1050 levels would surely make another breakthrough harder after the spike that briefly pushed prices above this level.

OKCoin BTC/USD weekly futures are still lead by traders that have gotten used to watching from a distance through the last few trading sessions. It’s no surprise that futures traders might want to play it safe as the last few hours showcased quite a bit of buying pressure in live markets.

OKCoin BTC/USD weekly futures are still lead by traders that have gotten used to watching from a distance through the last few trading sessions. It’s no surprise that futures traders might want to play it safe as the last few hours showcased quite a bit of buying pressure in live markets.

All in all, while there’s no good sign of a shifting market sentiment yet, traders were successful in exhausting selling pressure amid a trading session with high trading volumes. If it were for support levels to keep outweighing resistance in trading sessions to follow, it’s likely that the market’s sentiment would improve overall, and prepare for a more posiitve reception.