The MicroStrategy MSCI removal consultation threatens Strategy (MSTR) with index expulsion over its 649,870 BTC holdings. JPMorgan warns of $2.8B-$8.8B in forced passive fund outflows if the MicroStrategy MSCI removal proceeds.

KEY TAKEAWAYS:

- MSCI review threatens major outflows due to Strategy’s heavy Bitcoin concentration.

- Strategy’s software revenue is real but tiny beside $70B in Bitcoin holdings.

- Outcome may reshape how corporates structure and classify digital-asset treasuries.

The MicroStrategy MSCI removal threat places Strategy (NASDAQ: MSTR)—the enterprise software company formerly known as MicroStrategy—at risk of expulsion from MSCI equity indices due to its massive Bitcoin treasury holdings. The index provider is conducting a public consultation on whether companies with digital asset exposure exceeding 50% of their balance sheets should remain eligible for benchmark inclusion. Strategy’s 649,870 BTC position, currently valued at over $70 billion, places it squarely in the crosshairs of this policy review.

JPMorgan estimates that MSCI removal alone would force passive index funds to sell approximately $2.8 billion in Strategy shares, as reported by Investing.com. If S&P Dow Jones and FTSE Russell adopt similar thresholds, combined outflows could reach $8.8 billion. With public consultation closing December 31, 2025, and a final decision expected January 15, 2026, the outcome carries significant implications for Strategy’s stock price, passive fund flows, and potentially Bitcoin market liquidity.

MSCI, a major index provider that influences billions in passive investment funds, is reviewing whether companies whose digital asset exposure exceeds 50% of their total holdings should remain eligible for inclusion in its equity indices. This consultation places Strategy (formerly MicroStrategy), the largest corporate Bitcoin holder, at the center of a possible market-moving decision.

Note: Strategy is the current name of the company formerly known as MicroStrategy, effective Feb. 5, 2025. The MSTR ticker symbol remains unchanged on NASDAQ. Throughout this article, we use “Strategy” as the primary brand name while referencing its MicroStrategy legacy where relevant for search context and reader clarity.

Why the MSCI Decision Matters

Strategy’s (formerly MicroStrategy) balance sheet includes 649,870 BTC, currently valued at more than $70 billion, making it one of the world’s largest corporate Bitcoin holders. The scale places the company among the largest corporate holders of Bitcoin worldwide, a status resembling what is described as Bitcoin whale behavior in digital asset markets, holders whose transaction sizes can significantly influence market liquidity and price action.

If MSCI removes Strategy from its indices, the company itself will not be forced to sell any Bitcoin. However, index funds would be forced to sell Strategy stock. Those mandatory reductions could weaken liquidity (ease of buying and selling) in Strategy’s stock and potentially pressure Bitcoin prices, especially affecting other companies holding Bitcoin in their treasuries.

However, the MicroStrategy MSCI removal would trigger mandatory rebalancing across hundreds of passive funds, creating concentrated selling pressure.

Michael Saylor’s Defense: Strategy Remains a Software Company

MicroStrategy founder Michael Saylor has argued publicly that Strategy (MSTR) remains a genuine enterprise software business and should not be treated as a pure Bitcoin proxy. In a post on X, he stated that the company generates roughly $500 million per year from software products and services. He frames Bitcoin not as a passive holding but as an asset that strengthens the firm’s overall financial position.

His claim draws support from the most recent quarterly filing. During Q3 2025, Strategy reported $128.7 million in software revenue. This figure represents a 10.9% increase over the prior year. At that quarterly rate, the business generates about $515 million annually. These operations include enterprise analytics tools, subscription services, and long-established customer relationships. On its own, the software division is a durable and functioning business.

The software division’s steady growth occurs as more corporations explore Bitcoin treasury strategies, seeking to understand whether dual business models can coexist within traditional equity market classifications. Saylor thus argues that MSCI’s methodology fails to account for the operational reality of the company. He maintains that Bitcoin and software function together within a single corporate architecture rather than representing separate identities.

Verification: What the Numbers Actually Show

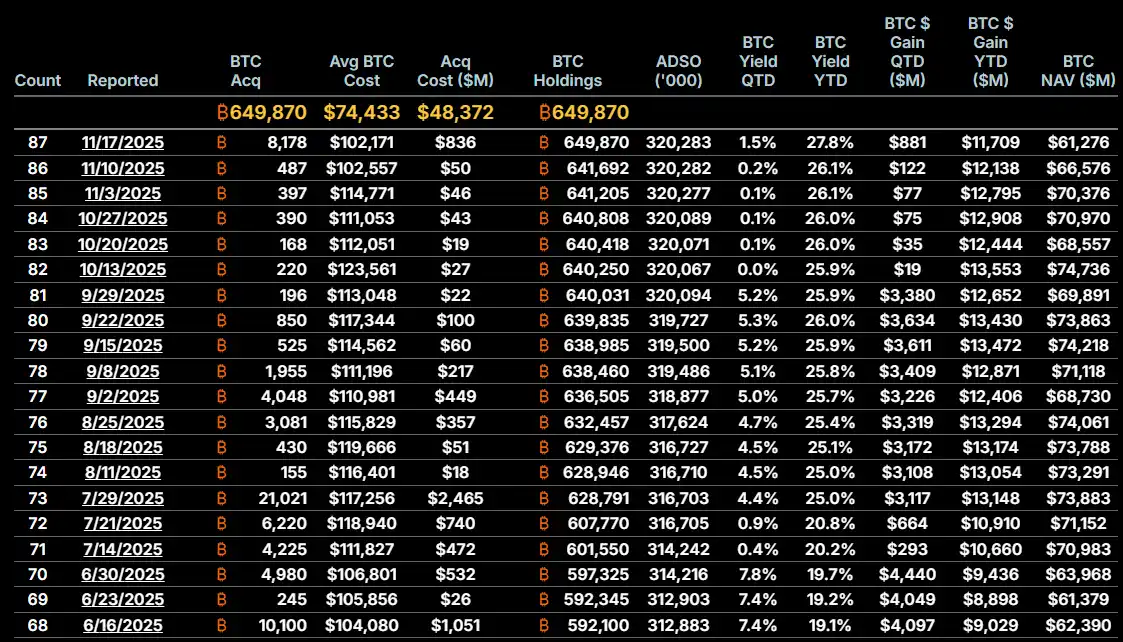

Strategy has been consistently buying BTC throughout the cycle Credit: Strategy

To evaluate Saylor’s defense, the analysis depends on examining both revenue contribution and balance sheet exposure. Software revenue is verifiable and meaningful. The business delivers $515 million annually and continues to grow at a steady rate. This output shows actual operations supported by real customers and recurring contracts. In terms of actual business operations, the division remains active and commercially relevant.

However, software revenue does not fully offset the scale of Strategy’s Bitcoin exposure. The company holds more than $70 billion in Bitcoin against roughly $515 million in annualized software revenue. Bitcoin therefore dominates the balance sheet by a margin that exceeds 99%. MSCI’s consultation focuses on asset concentration rather than revenue or operational scale. Under that framework, Strategy’s Bitcoin position far surpasses the 50% threshold under review.

Broader Implications for Corporate Bitcoin Treasury Models

Strategy has been the most visible company pursuing a Bitcoin-heavy treasury model since 2020. Its public success and high-profile acquisitions have influenced other firms to explore similar strategies. Some data-intensive companies now hold digital assets equal to more than half of their market capitalization, as reported in the Crypto News feature on Hyperscale Data’s treasury.

For individual investors wondering how to buy Bitcoin amid this institutional adoption trend, the infrastructure has matured significantly since Strategy began accumulating in 2020.

The decision also comes at a time when more corporations are exploring the use of Bitcoin within treasury and financing operations. Interest in Bitcoin-collateralized credit is growing, and companies across various sectors are starting to explore digital assets as long-term strategic investments, prompting questions about proper regulatory classification.

If MSCI confirms its proposal, companies with high Bitcoin positions may face incentives to restructure treasury arrangements to remain index eligible. Possible adjustments include transferring Bitcoin to subsidiaries, creating separate treasury entities, or diversifying holdings to reduce concentration risk. The review may also prompt more clarity on how digital assets fit within traditional frameworks of corporate classification.

The consultation also raises questions about what Bitcoin represents in corporate finance contexts, as a treasury reserve asset versus as a speculative investment. As more companies adopt Bitcoin as part of their long-term strategies, definitions of asset class, risk classification, and corporate identity are being tested.

MicroStrategy MSCI Removal Timeline: What Comes Next

The MSCI consultation remains open until December 31, 2025. The final decision is expected on January 15, 2026. If Strategy (MSTR) is removed from MSCI indices, passive fund outflows could begin within days as index funds rebalance their holdings. The MicroStrategy MSCI removal would mark one of the largest index-driven liquidations triggered by cryptocurrency exposure.

Understanding how Bitcoin halving cycles influence corporate treasury accumulation timing may also factor into Strategy’s future purchase patterns, regardless of index eligibility outcomes.

The MicroStrategy MSCI removal decision represents a watershed moment for corporate Bitcoin treasury strategies. If finalized, the precedent would fundamentally reshape how index providers evaluate companies with significant digital asset exposure.

At present, the data support three clear conclusions. Saylor’s software revenue claim is accurate. MSCI’s concentration concern is valid based on the balance sheet. The outcome of the consultation will determine which truth ultimately carries greater weight.

Written by Peter Macharia, Edited by Zoran Spirkovski.

MicroStrategy MSCI Removal: Frequently Asked Questions

What is Strategy’s relationship to MicroStrategy?

Strategy (NASDAQ: MSTR) is the rebranded name of MicroStrategy, the enterprise analytics software company founded by Michael Saylor in 1989. The company changed its name to “Strategy” in February 2025, but the MSTR ticker symbol remains unchanged. The company maintains both its legacy enterprise software business (approximately $515 million in annual revenue) and its Bitcoin treasury strategy (649,870 BTC valued at over $57 billion).

How much Bitcoin does Strategy (MicroStrategy) own?

As of Nov. 25, 2025, Strategy owns 649,870 BTC, valued at more than $57 billion at current prices. This makes Strategy the largest corporate Bitcoin holder globally, a position accumulated through consistent purchases since August 2020 under founder Michael Saylor’s “Bitcoin for Corporations” strategy.

Will Strategy (MSTR) be removed from MSCI indices?

MSCI is consulting on whether companies with digital asset exposure exceeding 50% of their balance sheet should remain index eligible. Strategy’s Bitcoin holdings exceed 99% of its total assets. The decision will be announced Jan. 15, 2026, after the public consultation period closes Dec. 31, 2025. MSCI has not pre-announced the outcome.

What happens if Strategy is removed from MSCI indices?

Passive index funds that track MSCI benchmarks would be required to sell their Strategy (MSTR) holdings to maintain proper index alignment. JPMorgan estimates MSCI removal would trigger approximately $2.8 billion in forced selling. If S&P Dow Jones Indices and FTSE Russell adopt similar policies, combined outflows could reach $8.8 billion. The MicroStrategy MSCI removal would likely impact Strategy’s stock price through this forced selling pressure, though the company itself would not be required to sell any Bitcoin.

Does Strategy have to sell its Bitcoin if removed from indices?

No. Index removal affects only passive fund holdings of Strategy stock, not Strategy’s corporate Bitcoin treasury. The company’s 649,870 BTC would remain on its balance sheet regardless of index classification. However, sustained stock price pressure from forced selling could theoretically complicate future capital raises if Strategy wanted to acquire more Bitcoin.

When was Strategy’s (MicroStrategy’s) last Bitcoin purchase?

Strategy’s most recent Bitcoin purchase occurred on Nov. 17, 2025, when the company acquired 8,178 BTC for approximately $836 million at an average price of $102,171 per Bitcoin.

Is Strategy still a software company?

Yes. Strategy generates approximately $515 million in annual revenue from enterprise analytics software products, with Q3 2025 software revenue of $128.7 million representing 10.9% year-over-year growth. The company serves enterprise customers with business intelligence, analytics, and cloud-based data platforms. However, Bitcoin holdings now represent more than 99% of the company’s balance sheet by value, creating the classification question at the center of the MSCI review.

What other companies hold significant Bitcoin in their treasury?

Besides Strategy’s 649,870 BTC, notable corporate Bitcoin holders include Tesla (still holds Bitcoin after 2021 purchases), Block (formerly Square, Jack Dorsey’s payments company), and emerging firms pursuing Bitcoin treasury strategies. However, no public company approaches Strategy’s Bitcoin concentration level relative to market capitalization.

How can I track Strategy’s Bitcoin holdings?

Strategy publishes Bitcoin acquisition announcements through SEC Form 8-K filings available on the SEC’s EDGAR database. The company also maintains a Bitcoin tracker on its investor relations website showing total holdings, average purchase price, and yield-to-date metrics. Third-party trackers like BitcoinTreasuries.org also maintain real-time corporate Bitcoin holding databases.

What is Michael Saylor’s view on the MSCI review?

MicroStrategy founder Michael Saylor has publicly defended Strategy’s index eligibility, arguing that the company generates real software revenue ($515 million annually) and that Bitcoin functions as a treasury asset that strengthens the overall financial position. In a post on X on Nov. 21, 2025, Saylor stated that Strategy is not a fund, not a trust, and not a holding company, but a publicly traded operating company with a unique treasury strategy that uses Bitcoin as productive capital. He has not indicated Strategy would reduce Bitcoin holdings to maintain index eligibility.