Last Updated: Dec. 14 2025

Zoran Spirkovski holds Bitcoin (BTC), Ethereum (ETH), and other digital assets. This article is for informational purposes only and does not constitute financial, investment, or trading advice. Cryptocurrency investments carry significant risk. Always conduct your own research and consult a qualified financial advisor before making investment decisions. Past performance does not guarantee future results.

Bitcoin has experienced dramatic price swings throughout its 15-year history, with crashes exceeding 80% occurring multiple times. For investors and observers wondering whether Bitcoin will crash again, understanding this volatility requires examining historical patterns, the factors that trigger major sell-offs, and the elements that have supported price recovery.

This analysis presents both the risk factors that could cause future crashes and the characteristics that have historically supported Bitcoin’s price. Neither perspective should be interpreted as a prediction of future performance.

Bitcoin’s Crash History

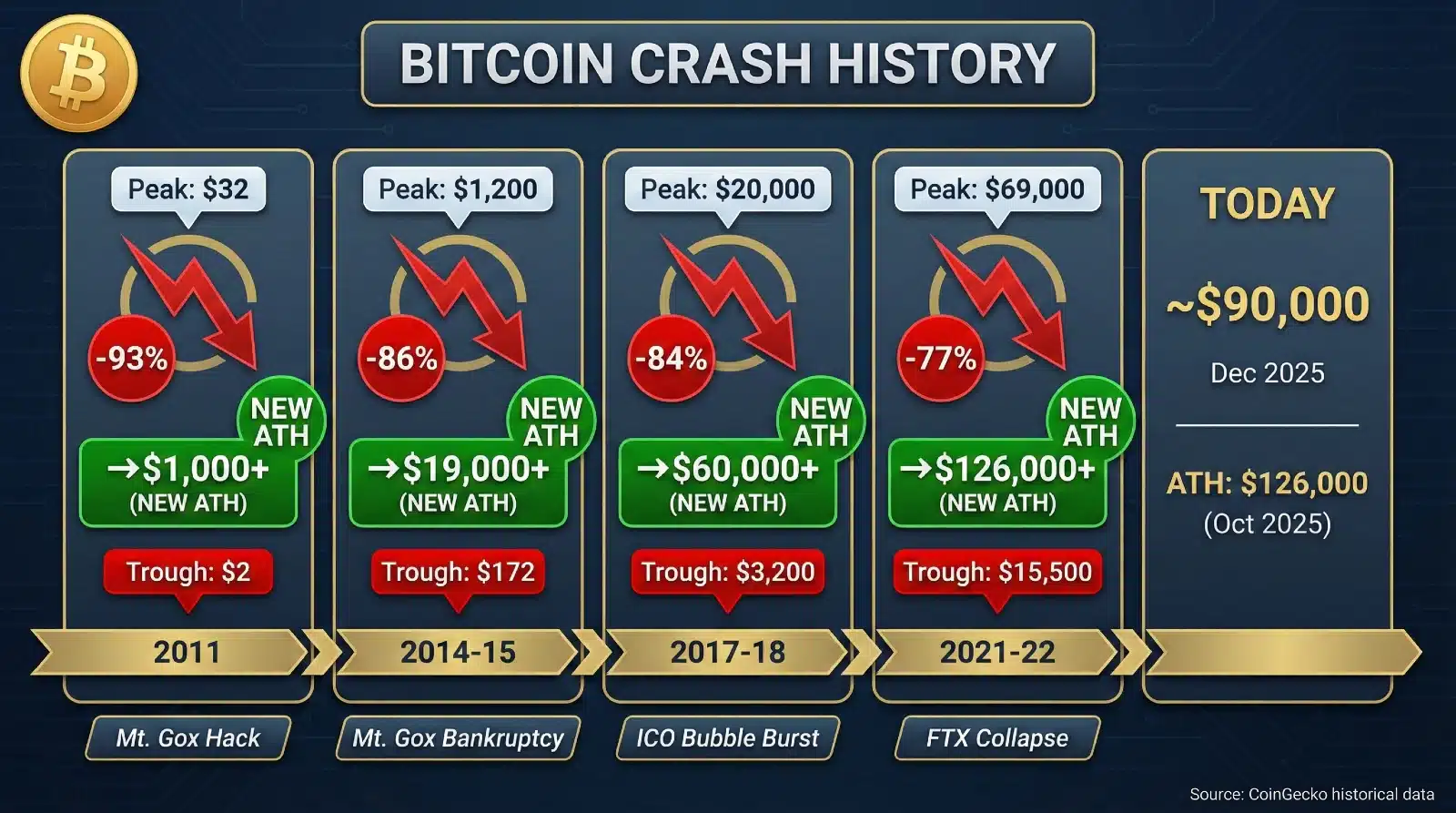

Bitcoin’s price history reveals a consistent pattern of severe crashes followed by recoveries to new all-time highs. According to CoinGecko historical data, four major crashes have defined Bitcoin’s market cycles.

The first major crash occurred in 2011, when Bitcoin fell from $32 to approximately $2, representing a decline of roughly 93%. This early crash coincided with the first Mt. Gox security breach and demonstrated the extreme volatility inherent in nascent cryptocurrency markets.

The 2014-2015 crash proved even more devastating. Following the Mt. Gox bankruptcy in February 2014, Bitcoin dropped from approximately $1,200 to $172, an 86% decline. The Mt. Gox collapse initially reported the loss of 850,000 BTC, though approximately 200,000 were later recovered, bringing the confirmed loss to around 650,000 BTC and shaking confidence in cryptocurrency exchanges and infrastructure.

During 2017-2018, Bitcoin reached nearly $20,000 before plunging to $3,200, an 84% drawdown that became known as “crypto winter.” This crash followed the initial coin offering (ICO) boom and subsequent regulatory scrutiny.

Most recently, the 2021-2022 crash saw Bitcoin fall from its then all-time high near $69,000 to approximately $15,500 following the FTX exchange collapse in November 2022, representing a 77% decline.

Despite these severe corrections, each crash has ultimately been followed by recovery to new all-time highs. As of December 2025, Bitcoin trades around $90,000-$93,000, having reached an all-time high of approximately $126,000 in October 2025. This pattern of crashes followed by higher peaks is a defining characteristic of Bitcoin’s market history, though it offers no guarantee of future performance.

What Causes Bitcoin to Crash?

Several categories of events have historically triggered major Bitcoin price declines.

Exchange failures represent one of the most significant crash catalysts. The Mt. Gox bankruptcy in 2014 and the FTX collapse in 2022 both precipitated major sell-offs. When major trading platforms fail, confidence in the broader cryptocurrency ecosystem suffers, often triggering panic selling.

Regulatory announcements have also sparked volatility. China’s repeated cryptocurrency bans and restrictions on mining have triggered multiple sell-offs over the years. Unexpected regulatory actions in major markets create uncertainty about Bitcoin’s legal status and accessibility.

Macroeconomic factors influence Bitcoin prices as well. Rising interest rates, inflation concerns, and broader market risk-off sentiment have contributed to Bitcoin declines, particularly as institutional involvement has increased.

Large holder activity, often called Bitcoin whale movements, can amplify price swings. When addresses holding significant amounts of BTC sell, the concentrated nature of these transactions can move markets, especially during periods of lower liquidity.

What Could Cause Future Volatility?

Several potential risk factors could contribute to future Bitcoin price declines.

Regulatory uncertainty remains a concern. While some jurisdictions have embraced cryptocurrency, others may implement restrictions that limit adoption or trading access. Major regulatory actions in large markets could affect price.

Competition from central bank digital currencies (CBDCs) represents a potential challenge. As governments develop their own digital currencies, some argue this could reduce demand for decentralized alternatives, though others contend CBDCs serve different purposes.

Technical vulnerabilities, while never exploited at the protocol level in Bitcoin’s 15-year history, remain a theoretical risk. Advances in quantum computing or undiscovered bugs could potentially affect network security.

Black swan events, by definition unpredictable, have historically affected all asset classes. Global financial crises, geopolitical events, or unforeseen technological developments could impact Bitcoin’s price.

What Supports Bitcoin’s Price?

Several factors have historically contributed to Bitcoin’s price resilience and recovery from crashes.

Fixed supply scarcity is fundamental to Bitcoin’s design. With a hard cap of 21 million coins coded into the protocol, Bitcoin’s supply schedule is predictable and immutable. The halving mechanism reduces new supply issuance approximately every four years, with the most recent halving in April 2024 reducing block rewards to 3.125 BTC.

Institutional adoption has accelerated significantly. The approval of US spot Bitcoin ETFs in January 2024 opened access to traditional investors. Corporate treasury adoption and growing financial services infrastructure have increased Bitcoin’s accessibility.

Network effects continue to grow. With over 15 years of continuous operation and no successful protocol-level attacks, Bitcoin has established a track record of security and reliability. The network’s hash rate, a measure of computational security, continues to reach new highs.

The Strategic Bitcoin Reserve established by executive order in March 2025 signals government recognition of Bitcoin as a reserve asset. The policy, capitalized with seized and forfeited Bitcoin, represents the first formal US government Bitcoin holding program.

Can Bitcoin Go to Zero?

The question of whether Bitcoin could become worthless warrants examination.

From a technical standpoint, Bitcoin’s decentralized network has operated continuously since January 2009 without successful protocol-level attacks. The distributed nature of the network, with thousands of nodes globally, makes complete failure unlikely absent a fundamental cryptographic breakthrough.

Network effects and adoption create resistance to complete value collapse. Millions of users, thousands of businesses accepting Bitcoin, and significant infrastructure investment create an ecosystem with inherent value beyond speculation.

However, no investment is without risk. Theoretical scenarios including regulatory bans across major economies, superior competing technologies, or catastrophic technical vulnerabilities could significantly impact Bitcoin’s value. While complete value loss appears unlikely based on current adoption and infrastructure, it cannot be definitively ruled out for any asset.

How Investors Approach Volatility

Those who choose to invest in Bitcoin employ various strategies to manage volatility risk. Before committing capital, many evaluate whether now is the right time to buy based on their personal circumstances. These approaches are presented for educational purposes and do not constitute recommendations.

Dollar-cost averaging involves making regular purchases of fixed dollar amounts regardless of price, reducing the impact of price volatility on average acquisition cost. This approach is used by some investors who prefer not to attempt market timing.

Position sizing based on risk tolerance means allocating only funds one can afford to lose entirely. Given Bitcoin’s historical volatility, some financial advisors suggest limiting cryptocurrency exposure to a small percentage of overall portfolios.

Time horizon consideration reflects that Bitcoin’s historical recovery pattern has occurred over multi-year cycles. Those with shorter investment horizons may face greater exposure to volatility risk.

Security practices including proper custody, cold storage for larger holdings, and avoiding concentration on single exchanges can reduce platform risk, though they do not protect against price volatility.

Conclusion

Bitcoin has crashed severely multiple times in its history, with declines exceeding 75% occurring on four separate occasions. Each crash has been followed by eventual recovery to new all-time highs, though past patterns do not guarantee future performance.

The factors that could cause future crashes include regulatory actions, exchange failures, macroeconomic shifts, and unforeseen events. The factors that have historically supported recovery include fixed supply scarcity, growing institutional adoption, network security, and expanding use cases.

Whether Bitcoin will crash again is ultimately unknowable. What historical data demonstrates is that significant volatility has been and likely will remain a feature of Bitcoin markets. Individual circumstances, risk tolerance, time horizon, and financial situation should guide any investment decisions, which should be made in consultation with qualified financial advisors.

This article is for informational purposes only and does not constitute financial, investment, or trading advice. The author holds Bitcoin and other digital assets. Past performance does not guarantee future results. Consult a qualified financial advisor before making investment decisions.

Change Log

- Dec 13, 2025 – Added internal link to “Should I Buy Bitcoin Now?” guide

- Dec 7, 2025 – Article originally published.

Sources

- CoinGecko. (2025). Bitcoin Historical Price Data. https://www.coingecko.com/

- Wikipedia. (2025). Cryptocurrency bubble. https://en.wikipedia.org/wiki/Cryptocurrency_bubble

- Wikipedia. (2025). Mt. Gox. https://en.wikipedia.org/wiki/Mt._Gox

- White House. (2025, March 6). Fact Sheet: President Donald J. Trump Establishes the Strategic Bitcoin Reserve. https://www.whitehouse.gov/fact-sheets/2025/03/

- Blockchain.com. (2025). Bitcoin Charts. https://www.blockchain.com/charts/

- Coinbase. (2025). Bitcoin Price. https://www.coinbase.com/price/bitcoin