Last Updated: Dec. 14, 2025

If you’ve played Escape from Tarkov or other video games featuring Bitcoin farms, you might wonder whether these operations exist in the real world. They do, and they’re far more complex than any game depicts. A Bitcoin farm (sometimes called a crypto farm) is a large-scale Bitcoin mining operation that uses specialized hardware to validate transactions and earn newly minted BTC.

How Bitcoin Farms Work

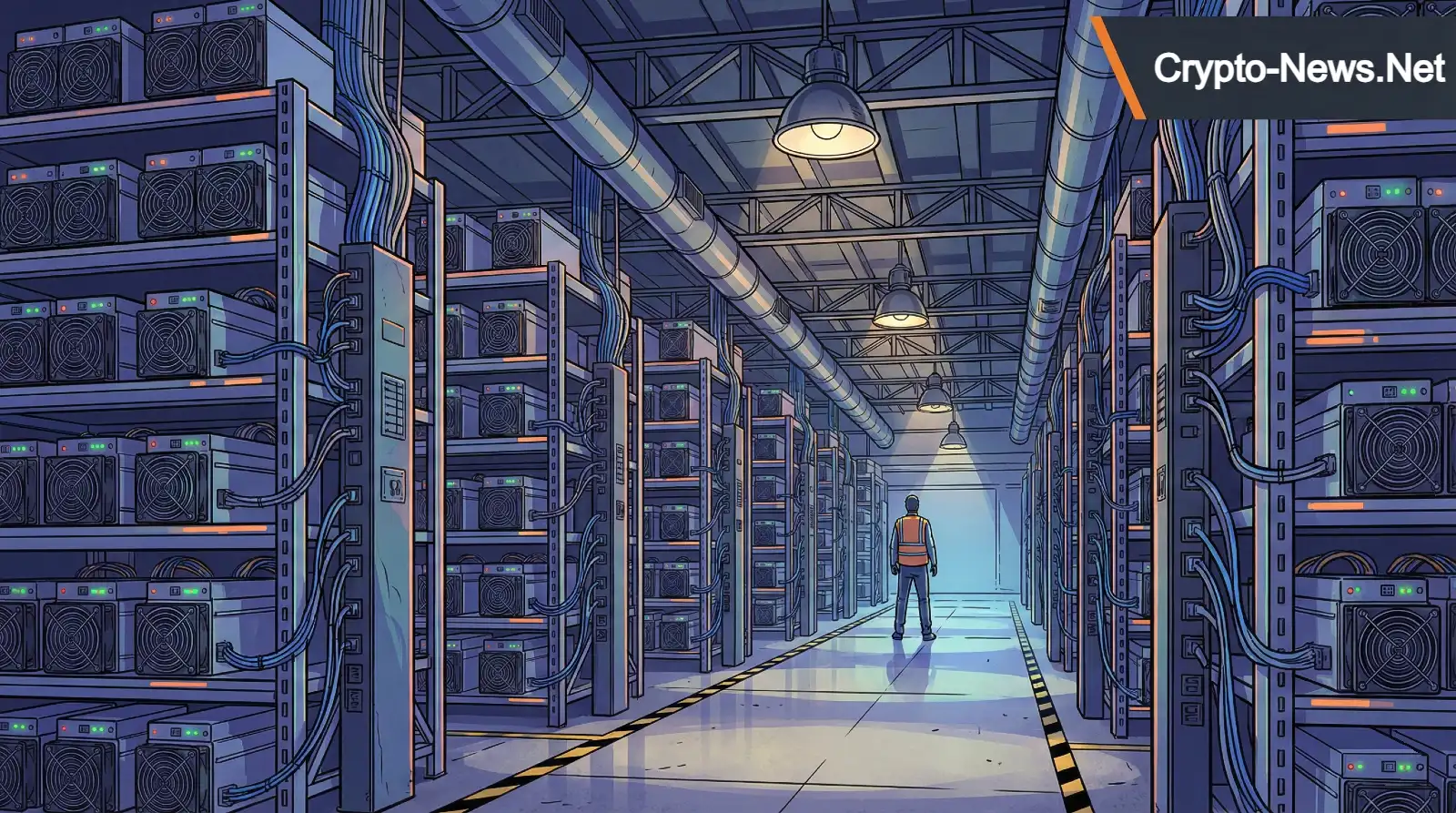

Bitcoin farms house hundreds or thousands of ASIC miners (Application-Specific Integrated Circuits) designed exclusively for Bitcoin mining. According to WhatToMine, modern ASICs produce anywhere from 200 to over 500 terahashes per second, far exceeding what consumer hardware achieves.

These operations require substantial infrastructure beyond the mining hardware itself. Industrial cooling systems prevent equipment from overheating, while high-capacity electrical systems deliver the enormous power these facilities demand. Professional Bitcoin mining farms typically occupy warehouses or purpose-built facilities, with rows of mining rigs operating continuously.

The mining process involves solving complex mathematical puzzles to validate Bitcoin transactions. When a farm’s hardware solves a puzzle first, the operator earns the block reward, currently 3.125 BTC following the April 2024 halving. Beyond earning Bitcoin, these operations contribute to network security by adding computational power that makes the blockchain more resistant to attacks.

Bitcoin Mining Farm vs. Home Mining

The economics of Bitcoin mining have shifted dramatically toward industrial-scale operations. While individuals can still mine Bitcoin at home, farms benefit from several advantages that make competition difficult.

Economies of scale allow farms to negotiate lower electricity rates and purchase hardware in bulk at discounted prices. Professional operations also optimize every aspect of their setup, from airflow management to power efficiency. These factors combine to give farms significantly lower production costs per Bitcoin than home miners achieve.

Most individual miners now join mining pools rather than competing directly with industrial farms. This allows smaller participants to contribute computing power collectively and share rewards proportionally.

Where Are Bitcoin Farms Located?

Geography plays a crucial role in Bitcoin mining profitability. According to the Cambridge Bitcoin Electricity Consumption Index, the United States, China, and Kazakhstan collectively account for the majority of global mining activity, representing approximately 65-75% of the network’s hashrate. The US currently leads as the largest mining country by hashrate.

Location decisions depend primarily on electricity costs and climate conditions. Regions with cheap, abundant power, particularly from hydroelectric or other renewable sources, attract mining operations. Cooler climates reduce cooling costs, which can represent a significant portion of operating expenses.

Major publicly traded mining companies like Marathon Digital and Riot Platforms operate large-scale facilities across North America. Marathon, for example, reports hashrate capacity exceeding 30 exahashes across its operations.

Some jurisdictions have actively courted Bitcoin miners with favorable regulations and energy pricing, while others have restricted or banned mining operations entirely.

Environmental Considerations

Bitcoin mining’s energy consumption remains a subject of debate. However, recent data suggests the industry’s environmental profile is improving.

The Cambridge Digital Mining Industry Report from April 2025 found that 52.4% of Bitcoin mining electricity now comes from sustainable sources, a significant increase from the previous estimate of 37.6%. This survey covered 48% of the global hashrate.

The industry’s shift toward renewable energy stems from both economic and public relations factors. Renewable energy sources, particularly hydroelectric and stranded natural gas, often offer the lowest electricity costs. Meanwhile, increasing scrutiny from regulators and the public has pushed operators toward cleaner energy sources.

Critics argue that Bitcoin mining still consumes substantial energy regardless of source. Supporters counter that the network provides security and utility that justify this consumption, and that mining can actually incentivize renewable energy development in remote areas.

Others raise concerns about mining centralization, as industrial farms concentrate hashpower among fewer operators, potentially affecting network decentralization over time.

The Tarkov Bitcoin Farm

For gamers who arrived here wondering about the Bitcoin farm in Escape from Tarkov: the in-game mechanic simulates mining in simplified form. Your hideout’s Bitcoin farm uses graphics cards to generate Bitcoin over time, which you can sell for in-game currency.

Real Bitcoin mining works on the same basic principle: hardware performing computational work to earn Bitcoin, but at vastly greater scale and complexity. The game’s representation captures the concept while abstracting away the technical and economic realities covered in this article.

Conclusion

Bitcoin farms represent the industrial evolution of cryptocurrency mining. These large-scale operations leverage specialized hardware, cheap electricity, and professional management to mine Bitcoin profitably. While home mining remains possible, the economics increasingly favor industrial operations.

Understanding how Bitcoin farms work provides insight into the infrastructure securing the Bitcoin network. As the industry matures, farms continue adapting to regulatory changes, energy costs, and the ongoing reduction in block rewards through the halving mechanism.

Disclaimer

This article is for informational purposes only and does not constitute financial, investment, or trading advice. Cryptocurrency investments carry significant risk. Always conduct your own research and consult a qualified financial advisor before making investment decisions.

Change Log

December 14, 2025: Added information about mining centralization concerns, network security contributions, and examples of major mining companies (Marathon Digital, Riot Platforms). Improved source citations for geographic distribution data.

December 6, 2025: Original publication.

Sources

- Cambridge Centre for Alternative Finance. (2025). Cambridge Bitcoin Electricity Consumption Index (CBECI). https://www.cbeci.org/

- Cambridge Centre for Alternative Finance. (2025, April). Cambridge Digital Mining Industry Report. University of Cambridge.

- Bitcoin.org. How Bitcoin Mining Works. https://bitcoin.org/

- Blockchain.com. (2025). Bitcoin Block Reward Data. https://www.blockchain.com/charts/

- WhatToMine list of ASIC BTC Miners https://whattomine.com/coins/1-btc-sha-256/asics

- Marathon Digital Holdings. Investor Relations. https://ir.mara.com/

- Riot Platforms. Company Information. https://www.riotplatforms.com/