If you’ve bought Bitcoin as an investment, there are two ways to go forward: either hoard them and watch as the price rises, or exchange Bitcoin with other altcoins. While the former may have a long term advantage (Bitcoin has risen more than 400% from October 2016), the process is lengthy and may not yield enough rewards in the short term. Instead, altcoin trading can offer some brilliant returns in a very short period – I’ve had profits of nearly 50% a week on some lucky occasions.

Understanding Altcoin Trading

Altcoin (or Alternate Coin) is a generic term for any cryptocurrency other than Bitcoin. Many of these currencies are still at infancy and likely to have a tremendous growth in price over the next few months. Others, like Ethereum for example, have already established themselves as being powerful currencies like Bitcoin.

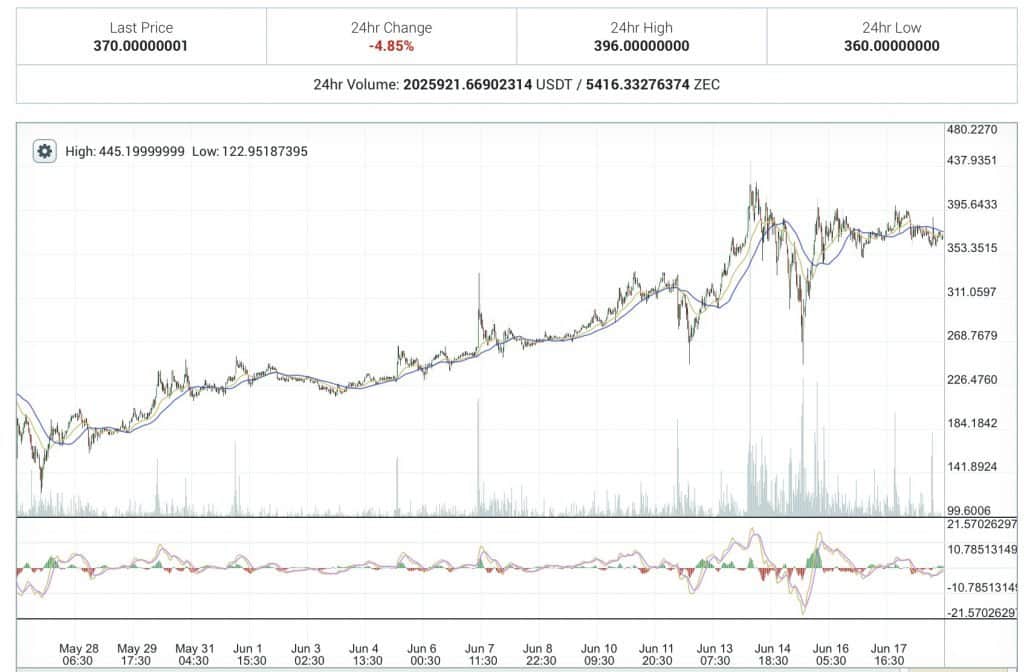

Altcoin trading involves exchanging one coin for another, to obtain daily or weekly profits. In very simple terms, you must buy an altcoin when it is cheap and sell when its price is high. How do you determine whether an altcoin is going to fall or rise? Well, it involves speculation. An analysis of the cryptocurrency graph can reveal its future trend. Also, don’t hesitate to look up speculations online, though you must be warned that not all speculations are correct.

But how do you exchange Bitcoin for altcoins? This is where exchanges come in. A cryptocurrency exchange is a website where you can buy or sell altcoins for Bitcoin. You have to place an ‘order’ to buy or sell a specific amount of a coin for a specified price. Once someone is ready to sell/buy the coin at your price, your coins will automatically be sold (your order will be filled).

This may sound a bit confusing at first, but trust me, once you start trading, all of this will make sense.

The most popular exchange today is Poloniex. Once you register at Poloniex, you will be provided with a number of wallet addresses for each coin listed on the exchange. You can transfer Bitcoins from your personal wallet to the exchange address to start trading. Then, visit the ‘Exchange’ section by clicking on the title bar. Once you’re in the exchange, you will see a column that says ‘Markets’ with a list of cryptocurrencies underneath it. All you have to do is select the currency you want to trade, place a buy/sell order and wait for your profits to come in.

Risks of Cryptocurrency Trading

Most Bitcoin holders know that it is a volatile currency. Altcoins are more volatile than Bitcoin and can lose big parts of their value in a matter of seconds. I’m not trying to scare you, but that is the risk you must be willing to take. Recently, Bitcoin crashed nearly 20% in one day. Bitcoin is an established currency, so it can recover from a big price fall. The same cannot be said for all altcoins. A destabilization could be catastrophic to some.

I encourage all readers to carefully evaluate the risks and the chances before they start trading. Prices can go down for a few days and rise back up later, so it is not the best strategy to sell your coins when their price is low (even if the trend may suggest a further drop in prices, analyze whether it is worth selling you coins at a loss).

Making use of the ‘Stop-Limit’ as Protection

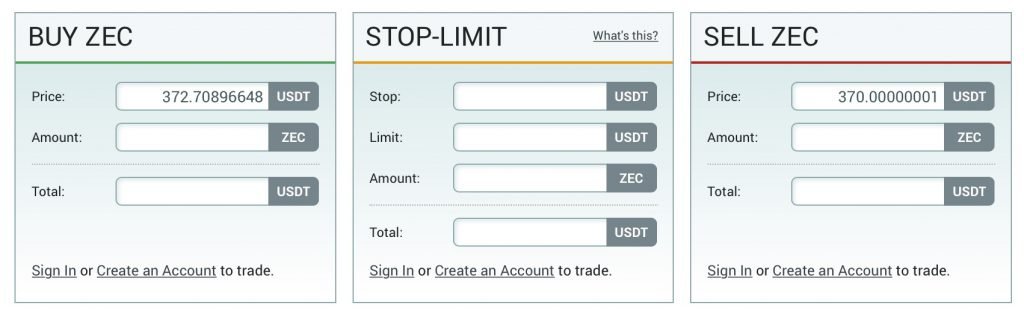

The previous section may make it seem like altcoin trading is very risky (and it can be), but that’s not always the case if you’re careful with your money. Poloniex has a feature called ‘Stop Limit’ (pictured above) which is specifically designed to help you protecting your profits. Here is an example provided by Poloniex:

Suppose you bought 100 LTC at a price of 0.023 BTC. It’s now at 0.026 BTC. You’ve made some profit, but you’re feeling good about LTC and think it has nowhere to go but up. At the same time, you’re aware that crypto is volatile, and that tomorrow’s headline (“Mt. Gox Loses 750 Million LTC”) could cause the price to crash. How can you hold your LTC, but make sure you get out if a crash comes? Place a stop-limit order with these parameters:

Stop: 0.024 BTC

Limit: 0.023 BTC

Amount: 100 LTC

Then click “Sell” in the stop-limit box. A confirmation box will come up telling you what will happen: “If the highest bid drops to or below 0.024 BTC, an order to sell 100 LTC at a price of 0.023 BTC will be placed.”

What this means is that you can set a stop limit order for protection. If the pair you’re trading drops below the ‘stop’ rate, a sell order for your ‘amount’ will automatically be placed at the ‘limit’ exchange rate. You can also use this feature while buying. The order will trigger if the current price of the pair exceeds the ‘stop’ price.

Therefore, with a bit of caution, you can turn altcoin trading into a profitable business which yields considerable short term and long term profits. However, be aware that there is no guarantee for trading profits and you should never risk more than you’re comfortable losing.