KeyTakeaways:

- Justin Sun’s Ethereum withdrawals raise concerns over short-term price pressure on ETH.

- Ethereum’s 71.5% growth in 2024 signals potential, but Bitcoin outpaces it with 142% rise.

- Technical indicators show bullish momentum, with ETH aiming for a possible rally to $4,000.

Justin Sun, the founder of the Tron blockchain, has again sparked market speculation with his recent move to withdraw over 52,000 ETH, valued at $209 million, from Lido Finance.

This large transaction adds to a series of Ethereum withdrawals Sun has made in recent months, raising concerns about the potential short-term effects on Ethereum’s price.

Blockchain analytics firm Spot On Chain reports that Sun has accumulated 392,474 ETH across multiple wallets, amounting to roughly $1.19 billion. His transactions have resulted in a net profit of $349 million, marking a 29% gain from his Ethereum holdings.

The Impact of Sun’s Previous Withdrawals

Sun’s history of Ethereum withdrawals has already had notable consequences on the market. In October 2023, he unpledged over 80,000 ETH, worth about $131 million, from Lido and transferred it to Binance.

This move led to a dip in Ethereum’s price, which fell by 5% mid-month. This latest withdrawal has reignited concerns about potential market instability, with analysts forecasting possible short-term pressure on Ethereum’s value as the market watches Sun’s actions closely.

Ethereum’s Performance in 2024: A Slow and Steady Rise

Despite the recent withdrawals, Ethereum has posted a solid 71.5% increase in value since the beginning of 2024. However, Bitcoin has outpaced it, surging by 142% over the same period. While Ethereum’s price growth is respectable, it still trails behind Bitcoin, which has raised questions about its ability to reach a new all-time high soon.

In addition to Sun’s movements, Ethereum has seen notable growth in other areas, particularly its total value locked (TVL). According to Chinese reporter Colin Wu, Ethereum’s TVL increased by $2.22 billion in just one week, although this still lags behind Bitcoin’s $3.09 billion increase.

Ethereum also saw record-high inflows into spot exchange-traded funds (ETFs) from December 9 to December 13, totaling $855 million. The BlackRock ETF ETHA accounted for $523 million of these inflows, and Fidelity’s ETF FETH contributed $259 million.

Technical Indicators Suggest Optimism for ETH

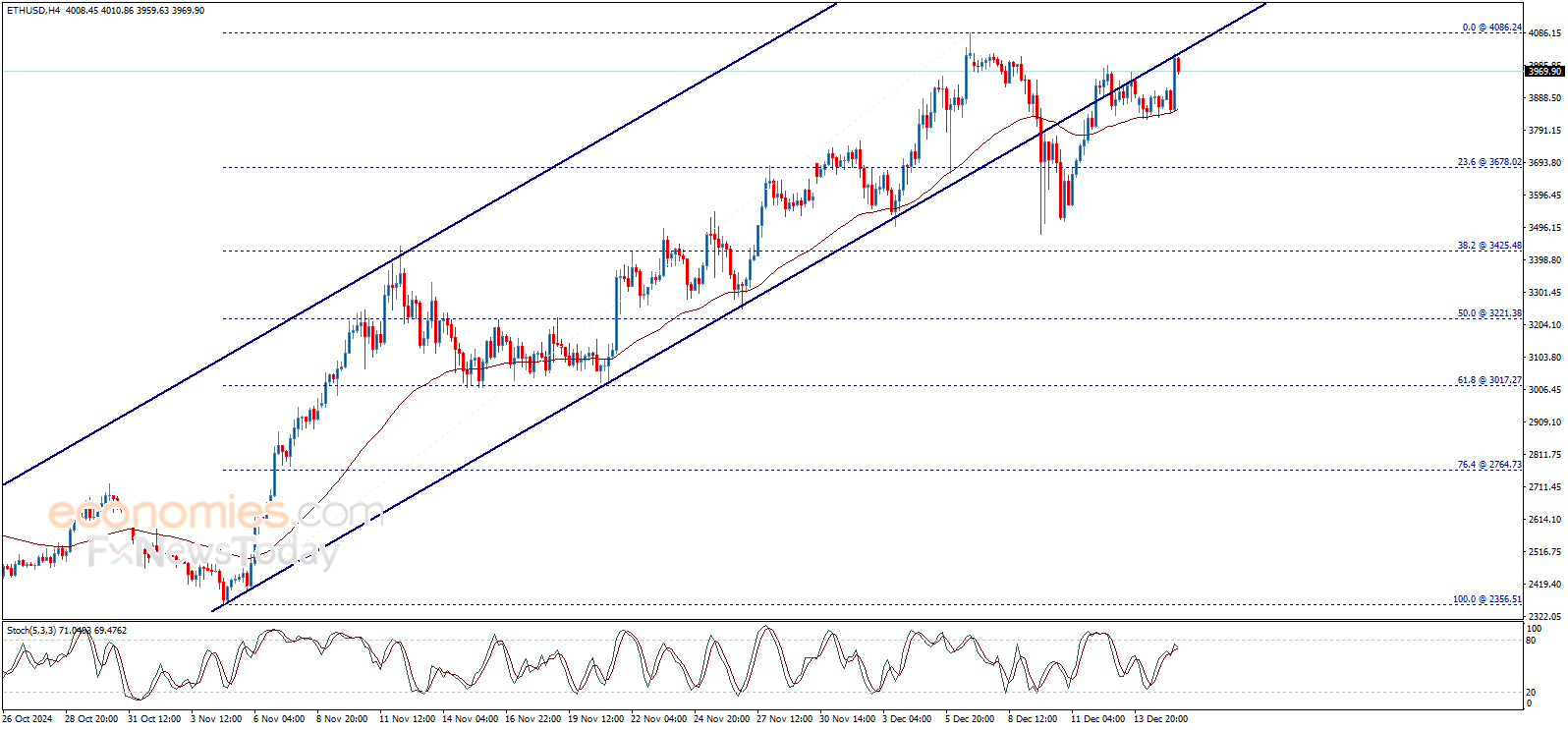

Ethereum’s technical charts have presented a more bullish outlook for investors. Analysts point to the recent formation of a “Golden Cross” on Ethereum’s weekly chart as a sign of potential upward momentum. This pattern was last seen in early 2021 before a 200% rally.

Additionally, the EMA50 trend line has supported Ethereum’s price from below, suggesting continued upward movement. Analysts have set a resistance level of $3,845, with a potential rally toward $4,000 if this level is breached.